Lessors come in all shapes and sizes and which one is right for you depends a lot on their background, focus area, access to funds, equipment expertise etc.

We can broadly classify them as those that are regulated (Non Banking Finance Companies licensed by the Reserve Bank of India) and those that are non-regulated (the business model does not require any special licensing).

Let us look at the different types and understand their strengths and weaknesses.

A. NBFC's - Regulated by the RBI

Leasing entities which are registered as an NBFC (Non Banking Finance Company) are regulated by the Reserve Bank of India. An NBFC registration has both advantages and disadvantages. A regulated NBFC definitely though, is a more resilient structure.

1. Original Equipment Manufacturer (OEM)

Many OEM’s across equipment categories have their own NBFC to finance the equipment they manufacture. These entities are generally the best for leasing if you have chosen to buy equipment made by them. They can almost always provide the best rates.

When leasing equipment from other OEM’s, they may have restrictions around the value and the type of equipment that they can include in your deal.

2. Independent

There are many independent NBFC’s which lease equipment.

Compared to the non NBFC’s, an NBFC can give better interest rates but can be more conservative in taking higher Residual Value positions.

A lot depends on whether it is an NBFC focused on a particular equipment type or is a larger NBFC where equipment leasing is just one of the many business lines.

A focused NBFC is generally expected to be smaller, with limited capital raising capability (read higher interest rates), but quick in decision making and with deeper expertise in equipment life cycle.

A larger NBFC with many business lines may not have the desired focus on the equipment leasing vertical, may be conservative on Residual Values and slower in decision making but may not have any capital challenges (read lower interest rates).

B. Non Regulated - Non NBFC

1. Original Equipment Manufacturer

Some of the OEM’s do not want to get into the regulatory hassles of forming an NBFC but can still lease their equipment if they are careful about compliances. For Operating Lease they do not need any special regulatory clearance and can also carry out some Finance Leases provided they stay within the regulations.

Please check my post highlighting the differences between an Operating and a Finance Lease.

2. Independent

Non regulated independent lessors are generally very aggressive and understand the Residual Market better than most other players. They are vendor agnostic and can be very quick. However, they may have limited access to funds and their interest rates can be high.

Lessors with Residuary Accounting model or Leveraged Lease model belong to this category. They also have the advantage of access to multiple sources of capital.

3. White Label

This is setup where the OEM does not do any leasing in its own books but has a dedicated team which identifies and negotiates lease terms with its customers and facilitates the lease with any of the lessors it has a tie up with.

This model is easy to set up and does not require any separate compliances but the OEM is dependent on the Lessor-Partners to a large extent.

4. Renter

Renters are different from a leasing company in their working style. The major differences are:

- The lease contract periods and the lock-in periods are much shorter.

- The lease contract either does not exist or is much simpler.

- They are completely dependent on their own funds and borrowings.

- They are the quickest.

- Their rental rates are the highest.

- They generally serve a customer base with a lower credit risk profile.

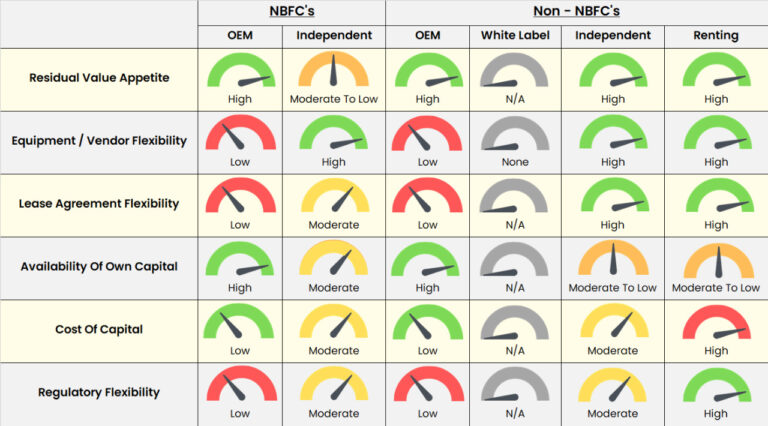

A Quick Snapshot

Here is a quick snapshot of the key attributes to help you decide which type of Lessor is right for you.

Conclusion

It’s obvious, that as a Lessee, if you are aware of the business model and the strengths and weaknesses of your Lessor, it can help you get the best equipment leasing deal.

Sometimes you may have unique requirements. Let’s say you are evaluating an equipment sale and lease back transaction. In that case it will be important to find a Lessor who can provide you with the correct solution.

It would be good to also explain core difference between rent and operating lease

People offer get confused between rent and lease

Hi Vaibhav,

Yes thank you for pointing this out. I will write a specific blog on this.

Regards and stay safe.

Vineet

Pingback: Time Value Of Money - Part I | Assetz

Pingback: Operating Lease vs. Finance Lease | Assetz